06 March 2024

The car insurance market and rising premiums

3 minutes

The car insurance market remains a tough space for consumers trying to determine the best cover. Some are finding their premiums are increasing, and there are also vehicle owners finding it difficult to find insurance in the first place.

According to a report by global professional services firm EY, the sector experienced consecutive years of losses and in 2023 recorded the highest loss in over a decade1. These losses are being driven by rising claim costs which are having a more detrimental impact on insurers than anticipated. We’re therefore seeing premiums continuing to rise and underwriters being more selective. But what’s driving these rising claims costs? Let’s take a closer look.

Inflation and technology

- Repairs are more expensive due to the increased cost of manufacturing and the distribution of parts – driven by inflation and, in particular, rising energy prices.

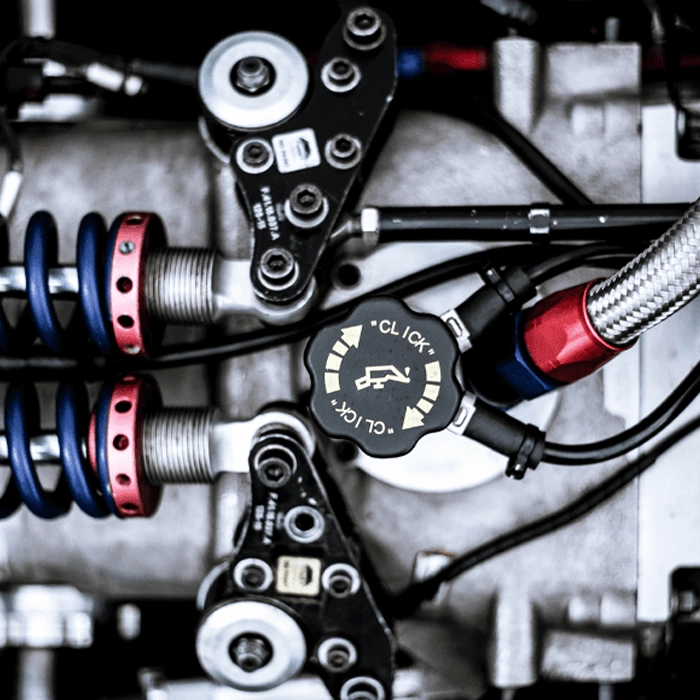

- The complexity of vehicle technology directly impacts the cost of repairs. Even simple claims for windscreens and bumpers are costing insurers more.

- Electric vehicles (EVs) are increasingly popular, and the specialist expertise required to repair them, along with the expensive parts involved, means a costlier claim.

- The second-hand car market is seeing cars hold their value, meaning that insurer costs are increasing if a vehicle needs to be replaced.

Supply chain issues and labour shortages

|

|

|

|

Vehicle theftsRange Rovers have been targeted by professional thieves for some time. But this trend isn’t limited to 4x4s. According to Aviva, one of our insurance partners, towards the end of last year they were seeing an unfortunate trend in luxury vehicle theft claims - namely Bentley and Ferrari - in Central London. This rise in vehicle thefts is leading some insurers to refuse cover on a number of vehicles. Others are demanding a higher premium as well as more security features, such as trackers and ghost immobilisers. |

Large personal injury claims

The shortage of care workers is resulting in increased costs for providing long-term care for those who require it after an accident. And this is particularly impactful as the expertise and support of these workers is crucial in handling personal injury motor claims effectively.

Managing car insurance premiums

All of this has led to a hard market meaning reduced competition, restricted cover, higher premiums, and more restrictive terms.

In a hardening insurance market, consumers may be tempted to forfeit cover in order to manage the cost of a premium. This doesn’t need to be the case. There are ways to manage your premium and still have the cover you need.

- Pay for small claims yourself. Insurers are tightening their belts and looking more favourably at clients with a good claims history. So, if you have minor damage and can afford to pay the costs, it could prove cost-effective overall as you could see your insurance premium increase by more than the cost of the damage.

- Apply a higher voluntary excess. You could also purchase an excess protection policy which may allow you to claim this amount back following a claim. The premium for this could be less than the discount you receive for taking a higher excess, so you could end up with a lower overall premium and have your excess covered.

- Enhance your vehicle’s security. Prevention is better than cure and making sure your vehicle is as secure as possible in the first instance will not only help keep your car out of harm’s way, but it also helps keep your car insurance premium down. There are a range of measures you can take to help secure your vehicle – you can read more about that here:

Car insurance & vehicle security. - Install a tracking device. If you own a supercar or performance vehicle, it’s becoming increasingly common for insurers to require owners to fit it with an approved car tracker.

- Consider a multi-vehicle policy. If you have more than one vehicle, then look for policies that allow you to combine all of your cars under one policy. Similarly, if your insurer is insuring your home as well as your vehicle then they’re likely to be much more flexible in their approach.

How can Howden help?

A hard market doesn’t mean a hard ‘no’ and a specialist broker like Howden has the experience, confidence, leverage, and contacts to secure the best policy deals and quotes.

Speak to one of our specialist team today so they can steer you towards the best insurance cover for your vehicles.

Sources:

1. https://www.ey.com/en_uk/news/2023/12/ey-s-latest-uk-motor-insurance-results

2. https://tide.theimi.org.uk/industry-latest/news/imi-predicts-160000-shortfall-workers-uk-automotive-sector-next-decade

3. https://www.abi.org.uk/news/news-articles/2023/5/above-inflation-costs-for-insurers-continue-to-put-pressure-on-motor-insurance-premiums/